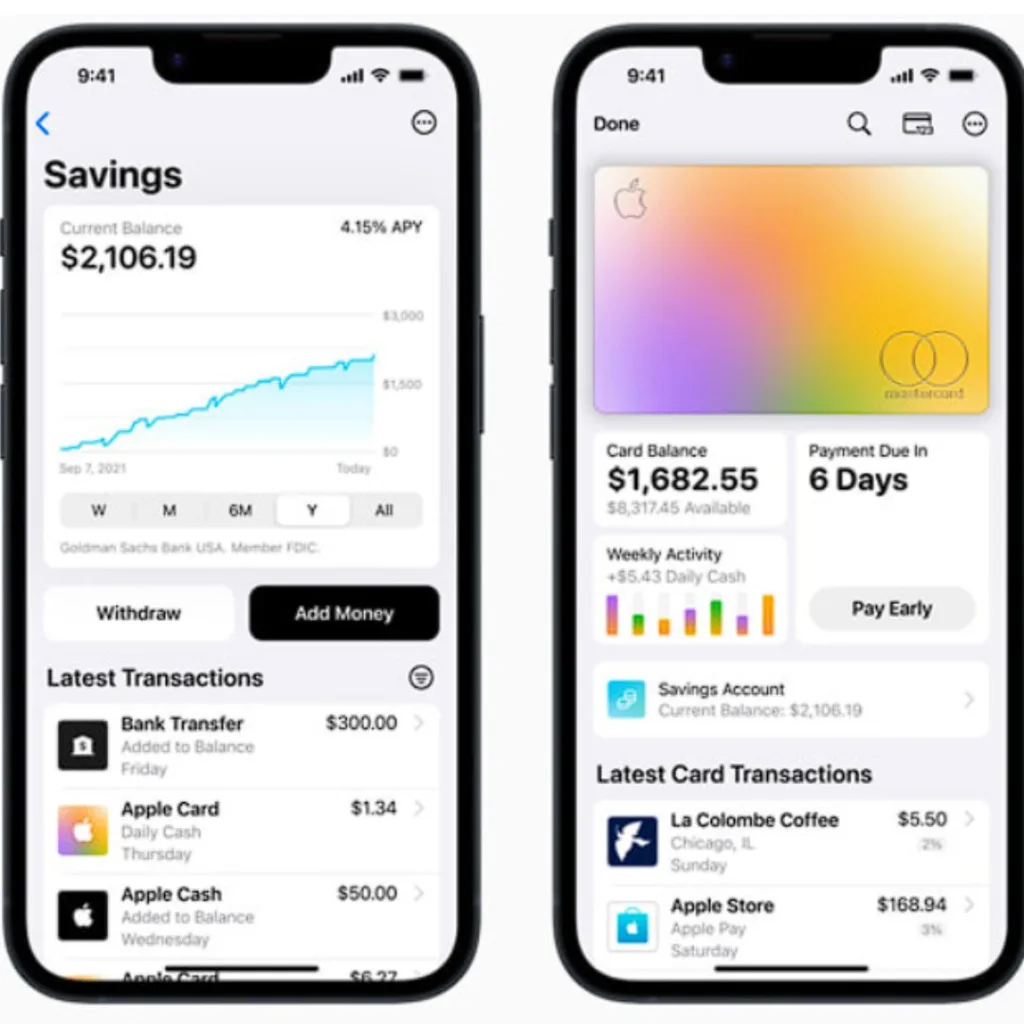

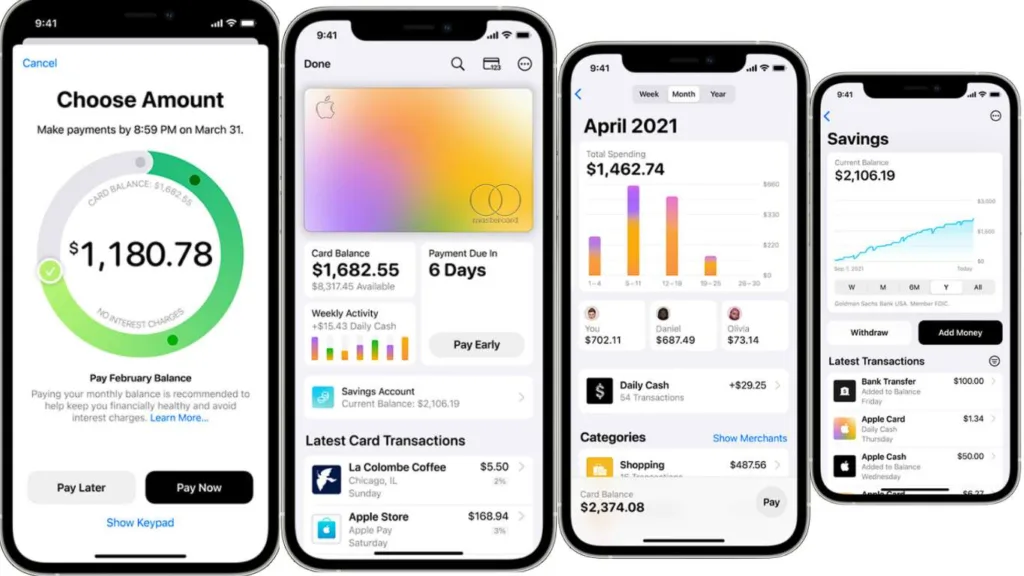

On Monday, Apple introduced the Apple Card Savings Account, which offers a competitive annual percentage return of 4.15 percent. Users may sign up for it using the Wallet app on their iPhones, and Apple claims there is no minimum deposit or amount required.

Apply your apple saving account HERE

The savings account can only be created using an Apple Card.

All Apple Card Daily Cash rewards would be transferred to the savings account, the business announced in a news statement. The Apple Card’s reward programme, Daily Cash, gives you up to 3% cash back on purchases. Customers have complete control over how and where their Daily Cash is transferred, and may even supplement their profits by transferring money from another account. Apple’s new savings account is being introduced by Goldman Sachs.

According to the Federal Deposit Insurance Corporation, the average annual percentage yield (APY) on savings accounts is just 0.35%, making Apple’s APY of 4.15% quite attractive. But, users may also find competitive savings accounts with considerable APY at several big credit unions, internet banks, and traditional brick-and-mortar banks.

With a minimum deposit of $5,000, savers at CIT Bank may earn 4.75% APR on their money. There is no minimum balance or service charge on Marcus by Goldman Sachs. The annual percentage yield is 3.9%. Capital One’s savings account offers a 3.5% annual percentage yield with no minimum balance requirement. There is no minimum balance requirement for the 4.77% APY savings account at Vio Bank.

The Wallet app will provide a dashboard for Apple Card savers, where customers can check their account balance, see their interest earned, and make withdrawals.

This functionality is now being rolled out to iPhone users through the Apple Wallet app.